Services performed but unbilled totals 0 – In the realm of accounting, the concept of services performed but unbilled holds significant importance. With a total of $600 in unbilled services, this topic demands our attention as we delve into its definition, accounting treatment, estimation methods, billing processes, financial implications, and internal controls.

This comprehensive exploration aims to shed light on this crucial aspect of financial management.

Services Performed but Unbilled Definition

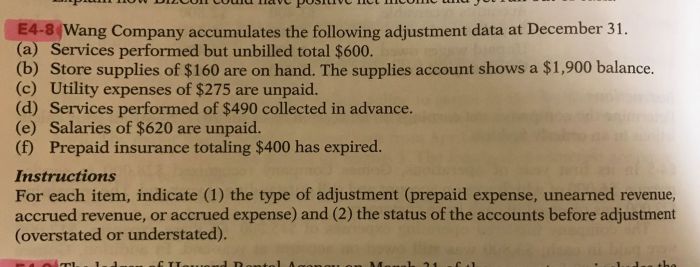

Services performed but unbilled represent services that have been provided to customers but have not yet been invoiced or billed. These services are considered to be earned revenue, but they have not yet been recognized on the income statement. Examples of services performed but unbilled include consulting services, legal services, and accounting services.

Services performed but unbilled are different from accounts receivable. Accounts receivable represent services that have been both performed and billed, but the customer has not yet paid for them.

Accounting Treatment of Services Performed but Unbilled

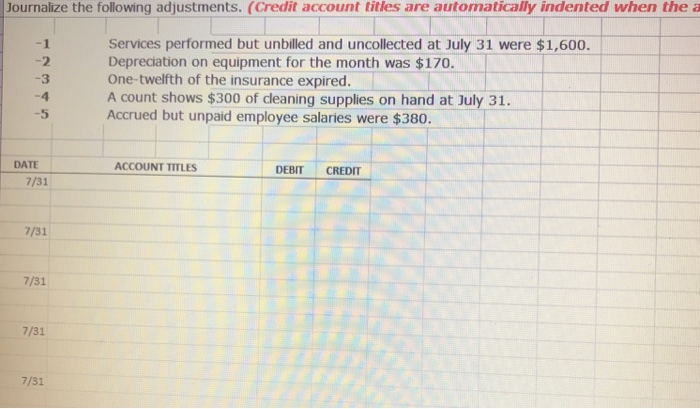

Under the accrual accounting principle, revenue is recognized when it is earned, regardless of when the cash is received. Therefore, services performed but unbilled should be recorded as revenue in the period in which the services were performed. The journal entry to record services performed but unbilled is as follows:

Debit: Accounts Receivable Credit: Service Revenue

This entry will increase the Accounts Receivable balance and the Service Revenue balance.

Services performed but unbilled will also impact the income statement and the balance sheet. On the income statement, services performed but unbilled will increase the revenue figure. On the balance sheet, services performed but unbilled will increase the Accounts Receivable balance.

Estimation of Services Performed but Unbilled: Services Performed But Unbilled Totals 0

It is often difficult to accurately determine the amount of services performed but unbilled. However, there are a number of methods that can be used to estimate this amount. These methods include:

- Using time sheets to track the hours worked on unbilled projects

- Using project completion reports to estimate the percentage of completion on unbilled projects

- Using other tools, such as billing software or project management software, to track unbilled services

It is important to note that the accuracy of the estimate of services performed but unbilled is critical. An inaccurate estimate can lead to errors in the financial statements.

Billing and Collection Process

Once services have been performed and billed, it is important to follow up with customers to ensure that the invoices are paid promptly. The billing and collection process should include the following steps:

- Sending invoices to customers promptly after services have been performed

- Following up with customers who have not paid their invoices

- Offering discounts or other incentives for early payment

- Taking legal action against customers who refuse to pay their invoices

An efficient billing and collection process can help to improve cash flow and reduce the amount of unbilled revenue.

Financial Implications of Services Performed but Unbilled

Services performed but unbilled can have a significant impact on a company’s financial statements. These services can affect a company’s cash flow, profitability, and solvency.

Unbilled revenue can be used for financial planning and decision-making. For example, a company can use unbilled revenue to estimate future cash flow and to make decisions about capital expenditures.

Internal Controls for Services Performed but Unbilled

It is important to have strong internal controls in place to ensure the accuracy and reliability of services performed but unbilled. These controls should include the following:

- Segregation of duties between the individuals who perform services, bill customers, and collect payments

- Authorization procedures to ensure that only authorized individuals can approve invoices

- Reconciliation processes to ensure that the amount of unbilled revenue is accurate

Regular reviews and audits of the internal controls should be performed to ensure that they are operating effectively.

User Queries

What is the difference between services performed but unbilled and accounts receivable?

Services performed but unbilled represent revenue earned but not yet invoiced, while accounts receivable are amounts owed by customers for goods or services already invoiced.

How can businesses estimate the amount of services performed but unbilled?

Time sheets, project completion reports, and other tracking tools can be used to estimate the value of unbilled services.

Why is it important to accurately estimate unbilled revenue?

Accurate estimation of unbilled revenue ensures reliable financial statements and supports informed decision-making.